CURRENT STATISTICS

Fully Funded Notes: 948

Financing Disbursed: RM576,326,921.00

Default Rate: 0.30%

CURRENT EVENTS & PROMOTIONS

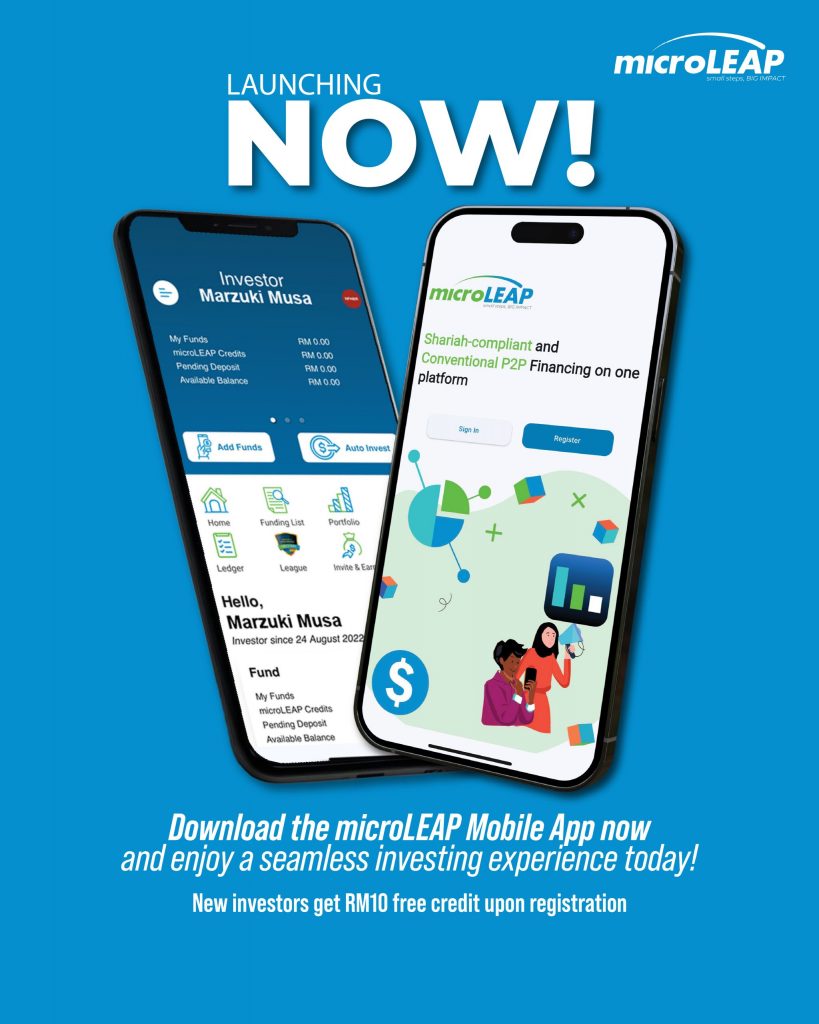

New Investors

Register now and get RM10 Free Credit!

Existing Investors

Earn RM10 Free Credit for every successful referral this month.

Enjoy a bonus RM50 Free Credit for every 5 successful referrals.

Promo Code:326MAR

Want to know how to be an Investor or Issuer? Watch our videos below in English or Bahasa Malaysia.

LEAGUE OF Extraordinary Investors

By investing in any of our Investment Notes, you automatically join our League and you earn points as you rise through the ranks of Rookie, Apprentice, Champion and Sifu.

Current Month Current Standings

REASONS TO BECOME A

P2P (Peer-to-Peer) Investor

18% Per Annum

Earn gross returns of up to 18%p.a. If you are looking for alternative investments and better returns than fixed deposits, then microLEAP is where you can put your funds to work!

RM10 Investment

From a minimum investment of only RM10, microLEAP provides the ability for you to diversify your portfolio by investing in many businesses. This helps you minimise the risk of default, which is key for a solid P2P Financing strategy

Social Impact

Many MSMEs (Micro, Small and Medium Enterprises) often find it difficult to raise funds via traditional banks. Through P2P Financing, we connect Investors (lenders) to Issuers (borrowers) and this will bring about a positive social impact for many underserved groups that we aim to assist

Regulated by SC

microLEAP is regulated by the Securities Commission Malaysia (SC). We comply with its strict rules and guidelines including using Trust Accounts to segregate our customers’ funds. Trust is a key factor in how we operate

Personal Accident Insurance

microLEAP provides Personal Accident Insurance on the business owner / key person that you are investing in, so that in the event of death / disability of that person, your outstanding investment amount is covered

Islamic & Conventional Notes

We offer both Shariah-compliant and Conventional Investment Notes. We believe that access to funding should be accessible to all MSMEs

Why become an Issuer?

Direct and Impactful

Issuers, registered Micro, Small & Medium Enterprises (MSME) that have been in operation for at least 6 months, may raise Shariah-Compliant or Conventional financing from as little as RM1,000 to RM500,000 via P2P (Peer-to-Peer) financing. We provide Micro and Macro P2P financing to the Malaysian MSME sector, the B40 to lower M40 income group, as well as any other businesses that requires business loans or financing. *B40 (Bottom 40% Income Group) are those that have a Median Household Income of RM3,000 a month and a Mean Household Income of RM2,848 a month (Department of Statistics Malaysia, 2017)

How to apply?

microLEAP Issuer

All applications are done online either through your PC, Laptop or via your mobile phone. Scan or take a picture of your documents and simply upload them on our platform. The funding proceeds must be used for a valid business however, as no personal financing is allowed on microLEAP.

How to Raise Funds?

Working Capital

With a small application fee of only RM50, we will credit score your business so that our P2P (Peer-to-Peer) Investors may make an informed decision before investing in you. Your Investment Note will be placed in the Funding List ready to be funded for a tenor of 6 to 36 months (3 years).

How do I make payments?

Simple Monthly Payments

Principal and Profit / Interest payments are done on a monthly basis and the exact amount is fixed over the tenor of the loan so that you know exactly how much you have to budget into your cashflow.

Added to that, we provide microinsurance via our Insurance Partner, so that the outstanding funds are covered in the event of death or total / partial disablement of the key person (Personal Accident Insurance).

This gives you peace of mind and allows you to concentrate on what you do best - growing you business!

Business Funding Calculator

Move the Funding Amount and Rate of Return slide-rules, then choose your Funding Tenor to get an indication of your monthly repayments.

To see what monthly repayments your business is qualified for, apply now.

*Your Rate of Return is dependent on your Credit Risk Score.

**This calculation is based on a fixed Issuer (Hosting) Fee. Actual Issuer (Hosting) Fee, which may vary, is deducted before disbursement of funds.

Provide an impact on local businesses with microLEAP!

Mikaysha Enterprise

by Nurmisha

microLEAP provides great and helpful service for young companies and small businesses. The process is hassle-free and staff is friendly and helpful. I highly recommend microLEAP for all entrepreneurs!

Lux Man Enterprise

by Luqman

microLEAP’s website is simple and easy to use especially for business financing needs. You can upload documents directly through microLEAP's website. Despite Covid19, Alhamdullillah my business and customer demand are growing. Financing from microLEAP has helped my business a lot especially for my working capital turnover.